Monthly Archives: November 2017

Autumn Budget 2017 – How will it affect motorists?

Wednesday 22nd November saw Chancellor of the Exchequer announce his Autumn budget speech to the House of Commons.

The Budget is the Government’s yearly announcement about how it will use nation’s money to fund services such as schools, the NHS, policing, housing and more. Taxpayers provide money for the Government, which then translates into the budget’s funding. Motoring taxes such as VAT, charged at the current rate of 20%, Vehicle Excise Duty (road tax), and fuel duty are some of the types of funding coming from vehicle owners that the budget utilises.

Trust My Garage believes that keeping you in the loop as a vehicle owner is of vital importance, so we’ve created a breakdown on how the changes announced in the budget could affect the UK’s motorists and the future of driving.

Fuel Duty

After much speculation, fuel duty has remained frozen for another year – meaning drivers of diesel vehicles will not be subject to increased costs for their fuel.

Road Tax

However, vehicle excise duty for diesel cars that do not meet the latest emission standards will rise by one band in April 2018 to crack down on the increasing levels of air pollution – so you could be paying anything from £15 to £500 more a year depending on how polluting your diesel vehicle is. As well as this, existing diesel supplements in company car tax will rise by 1%.

The Chancellor also reassured “white van men, and women” that company taxes on diesel vehicles will not hit them – The changes to company car tax for diesel vehicles are designed for cars only.

Electric Cars

As a benefit to motorists, Mr Hammond unveiled extra funding and tax incentives for electric car drivers in order to initiate further take up of electric vehicles (EVs). An extra £100 million is set to go towards helping people buy battery electric cars. The Government has also pledged to make sure all new homes are built with the right cables for electric car charge points.

In addition to the extra investments, electric cars charged at work will not incur benefit in kind, meaning they aren’t subject to taxation as fossil fuel-run vehicles are. This should encourage businesses to install charging points on their premises for employees – making it easier to charge your car at a convenient time.

The Government is also investing more funding into a cohesive electric vehicle charging infrastructure, once again ensuring you can stay charged up and ready to go no matter where you are if you choose to run an EV.

Driverless Technology

Thinking even further ahead, the Government has pledged to devote funding to driverless cars, considering them as the ‘next step’ after electric vehicles. The Chancellor announced that the UK will set out rules so that self-driving cars can be tested without a safety operator.

In Summary

Overall, the latest budget has been of mixed quality for motorists. Fuel duty prices have unexpectedly been frozen again to save you money, and the investment into electric vehicles will make it easier than ever to make the switch to a greener car and reduce air pollution for the next generation. However, the rise in costs for diesel vehicles is still set to affect many thousands of drivers across the UK.

No matter what the budget – be it yours or the UK’s – Trust My Garage is here to help you ensure your car is running at its best! If you’re looking for any kind of service or repair, you can use our handy Find a Garage map to locate your nearest Chartered Trading Standards Institute (CTSI) code of conduct approved member.

For more information about Trust My Garage you can also visit our website at www.TrustMyGarage.co.uk.

Got any thoughts or comments about how the Autumn budget could affect you? Tell us in the comments below!

Motoring scams – how can you stay safe?

When it comes to motoring, we at Trust My Garage want to make sure drivers stay as safe as possible on the roads. That’s why we’ve created our ever-growing network of trusted independent garages, to keep your vehicle running in optimum condition and keep you as happy as possible.

However, there are others who wish to ruin your motoring experience by submitting drivers to a variety of scams, which can damage both your vehicle and your bank account – and we don’t think that’s fair to you. In order to help you stay aware of potential dangers, we’ve put together information about some recent scams that have affected unfortunate motorists.

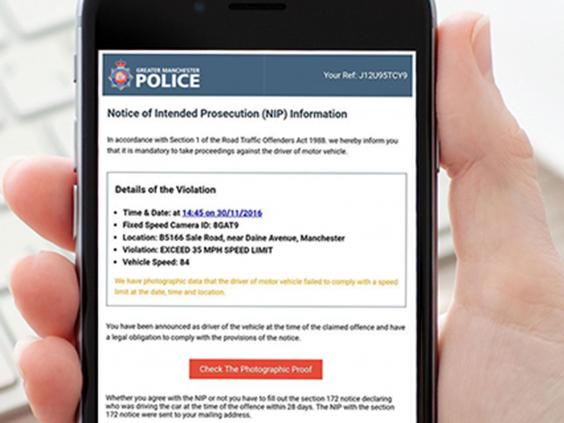

The speeding fine email

As recently as October 2017, scam emails have been circulated to motorists advising them of ‘Notice of Intended Prosecution’ or ‘NIP’ for a speeding offence. These emails have been supposedly sent from the Government or police and can even claim to have ‘photographic evidence’ of the offence, however they are completely false.

The only way legitimate notices of intended prosecution are sent is via Royal Mail to the Driver and Vehicle Licensing Agency (DVLA) registered address, so anyone who receives this email is advised to report it to Action Fraud, the national Fraud & Cyber Crime Reporting Centre, and delete it without clicking any links or attachments.

The whiplash accident

According to ABI figures, the national cost of whiplash claims makes up 20 per cent of the average insurance premium, while insurer Aviva claims that a staggering 94 per cent of all its compensation claims for motor accidents relate to minor whiplash. (source)

Minor whiplash is very hard to prove or disprove, but if you suspect someone is fraudulently claiming whiplash against you after a small collision, seek the advice of a solicitor to see if you can fight it.

There have been recent attempts to clamp down on false whiplash claims, however the difficulty in verifying the claims have led to new legislation, known as the ‘2015 dishonestly laws’, being put into place in order to correctly punish fraudulent claimants.

The ‘cash for crash’ scheme

‘Cash for crash’ is the nickname given to schemes where a scammer intentionally crashes into another driver in order to make a fraudulent claim on their insurance. Often tied in with whiplash claims, ‘crash for cash’ costs the UK £340m every year, with profits frequently funding other criminal activities such as firearms and drug dealing. The BBC states:

“Crash for cash scammers choose their victims carefully – they keep an eye out for drivers who look like they would be fully insured but be less likely to cause a fuss. Mothers with children on board and the elderly are favoured victims. If you’ve been a victim, the circumstances are likely to be as follows:

The accident

A car in front of you slams on the brakes for no obvious reason, and you have no time to react and collide with the car in front. Another scenario (known as ‘flash for cash’) happens when a driver flashes their lights at a junction to let you out, then crashes into you deliberately.

The blame

The other driver will insist the accident is your fault. The scammer will then hand over their insurance details – sometimes already prepared and written down.

The claim

A few weeks after the accident your insurers will write to you with details of the other driver’s claim which will be exaggerated with costs like car hire, recovery and whiplash injuries.” (source)

So how can you avoid this scam? It helps to pay attention to the driver and passengers of other cars around you – people frequently looking backwards or driving erratically can be a giveaway of a ‘cash for crash’ scheme in process. Try and keep a safe braking distance away from other vehicles and be sure to watch for cars turning and manoeuvring around you. Fraudsters may even try and disable their brake lights to try and cause an accident, so make sure to pay attention to your surroundings.

The online car-buying con

Not content with damaging your existing car, there has even been a scam designed to trap motorists purchasing cars online, via sites such as eBay. Cons like these use cloned cars – which is like automobile identity theft – to sell illegal vehicles under legal details, leaving buyers out of pocket with an illegal vehicle. The stolen vehicle is given the identity of a similar legitimate car, including licence plates, chassis numbers and accompanying documentation. Prospective buyers can run a background check on the car and the details will appear to be correct.

One victim lost £17,000 after paying in cash for a Mercedes later discovered to be cloned and was left with no way to regain their lost money due to no proof of transaction.

How can you avoid this scam? The best method is to purchase via authorised sellers, like garages and dealerships, but viewing a car in person is always beneficial and ensuring you pay for your purchase via a traceable, secure method means there is evidence of your purchase and the recipient of your money should anything go awry.

What should you do if you think you’ve been a scam victim?

The first steps in reporting a scam, especially one where you have lost money, should be to report it to Action Fraud. If you wish to get in contact with your local authorities for a crime number, you can also call or visit your local police station. For further information and for other types of scam advice, Citizens Advice can provide more information, viewable here.

Action Fraud

Telephone: 0300 123 2040

Textphone: 0300 123 2050

Monday to Friday, 9am to 6pm

Website: www.actionfraud.police.uk

About Trust My Garage

Trust My Garage is a collection of Britain’s best local garages – every one different and every one dedicated to the highest standards of skill and personal service.

All the garages in Trust My Garage are members of the Independent Garage Association which is part of the RMI, one of Britain’s oldest motor trade organisations. IGA members are true professionals who have to comply with a strict code of practice.

Each and every customer of all Trust My Garage members can rely on using a nationally recognised brand. If there’s a problem that can’t be sorted out between you and your garage, the IGA takes over and helps to achieve a happy outcome.

For more information about Trust My Garage or to locate your nearest TMG member visit www.trustmygarage.co.uk.